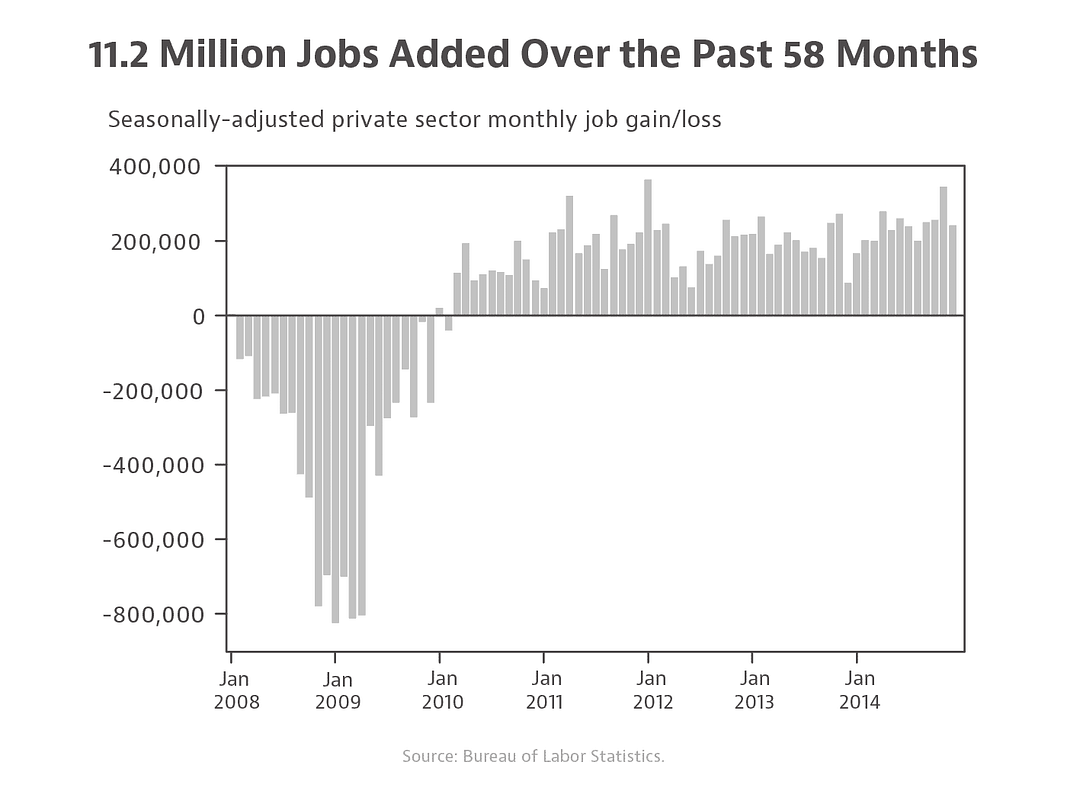

When the President took office in 2009, the economy was shrinking at its fastest rate in 50 years and shedding over 800,000 private sector jobs per month. The unemployment rate reached 10 percent that year, a level not seen in over 25 years. The housing market was in a free fall and the American manufacturing industry was thought to be in irreversible decline, with the auto industry nearing collapse. The deficit hit a post-World War II high, and health care costs had been rising rapidly for decades.

Today, the U.S. economy is recovering and, in 2014, achieved a number of important milestones. American businesses set a new record for the most consecutive months of job growth: 58 straight months and a total of 11.2 million new jobs, and counting. In 2014, the economy added more jobs than in any year since the 1990s. Significantly, nearly all of the employment gains have been in full-time positions. At the same time, the annual unemployment rate in 2014 fell 1.2 percentage points from the previous year, the largest annual decline in the last 30 years.

Over the last four years, the United States has put more people back to work than Europe, Japan, and every other advanced economy combined. As the economy strengthened, the unemployment rate fell from a high of 10 percent in 2009 to 5.6 percent at the end of 2014. Long-term unemploy- ment declined from 6.8 million in April 2010 to 2.8 million in December 2014 and fell even faster than overall unemployment over the past year.

For the first time in two decades, the United States has started producing more oil than it imports. Domestic natural gas production set a new record high in 2014. The manufacturing sector continues to experience its strongest period of job growth since the late 1990s. Rising home prices are bringing millions of homeowners back above water, restoring nearly $5 trillion in home equity.

The progress in the economy since the President took office has been steady and it has been real. The President’s decisive actions during the financial crisis brought the economy back from the brink, to the increasingly strong growth seen today. The Administration pushed the Recovery Act to jumpstart the economy and create jobs; rescued the auto industry from near collapse; fought for passage of the Affordable Care Act to provide insurance coverage to millions of Americans and help slow the growth of health care costs; and secured the Dodd-Frank Wall Street reform legislation to help prevent future crises. The American people’s determination and resilience, coupled with the Administration’s work, are driving the economy full steam ahead.

Helping, Not Hurting the Economy: The End of Austerity and the Move Away from Manufactured Crises

During the first years of the Administration, the President and the Congress worked together to enact measures that jumpstarted and strengthened the economy, and made it more resilient for the future. In addition to the Recovery Act, the Affordable Care Act, and Dodd-Frank Wall Street reform legislation, the Congress took bipartisan action in 2010 to temporarily reduce payroll taxes and continue emergency unemployment benefits.

Unfortunately, policies adopted in subsequent years hurt, rather than helped, the economy.

A Retrospective on 2013 Sequestration

When the Congress failed to enact the balanced long-term deficit reduction required by the Budget Control Act of 2011, a series of automatic cuts known as sequestration went into effect, cancelling more than $80 billion in budgetary resources across the Federal Government in 2013. Beyond the economic impacts, these cuts also had severe programmatic impacts, shortchanging investments that contribute to future growth, reducing economic opportunity, and harming vulnerable populations. For example:

Hundreds of important scientific projects went unfunded. The National Institutes of Health funded the lowest number of competitive research project grants in over a decade, providing roughly 750 fewer competitive grants in 2013 compared to the previous year. These unfunded grants included more than a hundred competitive renewal applications that were considered highly meritorious for additional funding in peer review, limiting research into brain disorders, infectious disease, and cancer. Also as a result of sequestration, the National Science Foundation awarded 690 fewer competitive awards than the previous year, resulting in the lowest total number of competitive grants provided since 2006, limiting scientists and students’ ability to pursue cutting-edge, potentially revolutionary discoveries.

Tens of thousands of low-income children lost access to Head Start. Over 57,000 children lost access to Head Start and Early Head Start in school years 2012–2013 and 2013–2014, forgoing critical early learning experiences and health and nutrition services intended to help improve their cognitive, physical, and emotional development. As a result, Head Start enrollment dipped to its lowest level since 2001. In addition, Head Start centers were forced to reduce the number of school days by more than 1.3 million. [1]

Fewer low-income families received housing vouchers. A total of 67,000 Housing Choice Vouchers were lost, resulting in reduced access to affordable, safe, and stable housing for low-income families. Although the Department of Housing and Urban Development and Public Housing Authorities took extraordinary steps to prevent families from losing assistance, many vouchers were withdrawn from families that were in the process of looking for housing or not reissued when families left the program, while many of the families remaining in the program faced higher rents.

While the Bipartisan Budget Act of 2013 replaced a portion of the damaging and short-sighted sequestration cuts in 2014 and 2015 with long-term reforms, they did not go far enough. Without further congressional action, sequestration will return in full in 2016, bringing discretionary funding — or, spending that is approved through the appropriations process — to its lowest level in a decade, adjusted for inflation. In fact, assuming roughly the current allocation of resources across programs, a return to sequestration levels in 2016 would mean the lowest real funding level for research since 2002 — other than when sequestration was in full effect in 2013 — and the lowest real per-pupil funding levels for education since 2000, a major disinvestment in exactly the areas where investment is needed to support growth.

[1] Head Start programs reported the number of days of service reduced because a shortened school year was required to implement the unprecedented reductions in their funding. The total number of days grantees reported eliminated from their school year is multiplied by the number of children affected by those cuts to produce the estimate that 1.3 million days of service were eliminated.

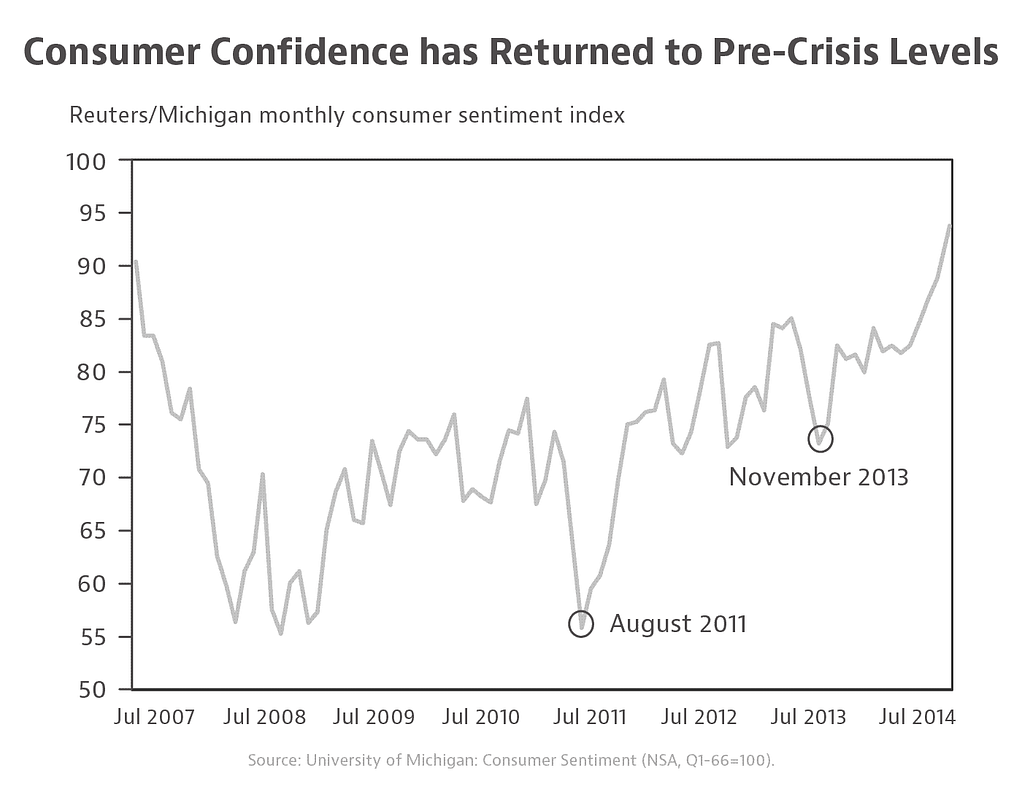

Sequestration cuts that took effect in March 2013 reduced the gross domestic product (GDP) by 0.6 percentage points and cost 750,000 jobs, according to the Congressional Budget Office (CBO). In 2011, and again in 2013, congressional Republicans sought to use the Nation’s full faith and credit as a bargaining chip, driving down consumer confidence and driving up economic policy uncertainty measures. The Federal Government shutdown in October 2013 created further uncertainty and reduced growth in the fourth quarter of 2013 by at least 0.3 percentage points.

Beginning in 2014, however, policymakers moved away from manufactured crises and austerity budgeting, helping to lay the groundwork for job market gains and stronger growth. The President worked with congressional leaders from both parties to secure a two-year budget agreement (the Bipartisan Budget Act of 2013) and enact full-year appropriations bills that replaced a portion of the harmful sequestration cuts and allowed for higher investment levels in 2014 and 2015.

The Council of Economic Advisers estimated that the 2013 budget deal will create about 350,000 jobs over the course of 2014 and 2015, meaning that it has likely contributed to the marked improvement in the labor market this past year. Moreover, thanks in part to the budget deal, 2014 will likely have been the first year since 2010 that Federal fiscal policy did not significantly reduce economic growth.

Increased certainty and a break from the threat of shutdown and other fiscal crises also added to growth, according to several independent analyses. For example, an analysis by Macroeconomic Advisers found that fiscal uncertainty cost 900,000 jobs from 2009 through mid-2013. The crises also negatively impacted consumer confidence, which fell markedly around the time of the 2011 and 2013 manufactured crises, and, along with small business optimism, has only returned to pre-recession levels in the past year (see previous chart). Business leaders, economists, and the Federal Reserve Chair have all attributed stronger growth in part to reduced fiscal headwinds and uncertainty, and business leaders have urged policymakers to avoid a return to manufactured crises and needless austerity.

Fiscal Progress

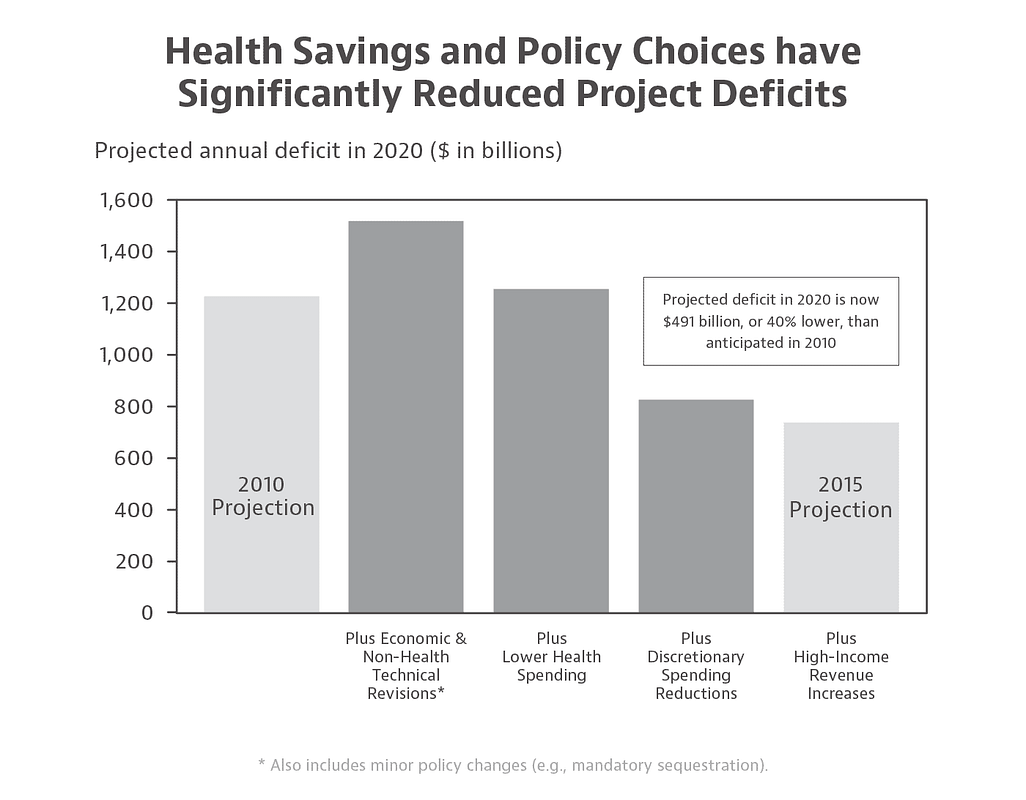

Since 2010, Federal deficits have shrunk at an historic pace — the most rapid sustained deficit reduction since the period just after World War II. The turn away from austerity in 2014 was accompanied by another steep drop in the deficit, bringing it to 2.8 percent of GDP — the lowest level since 2007, about one-third the size of the deficit the President inherited, and below the 40-year average. Over the past five years, actual and projected deficits have fallen due to three main factors.

First, economic growth has helped accelerate the pace of deficit reduction. Growth in recent years has increased revenues and reduced spending on “automatic stabilizers” programs, such as unemployment insurance, that automatically increase during economic downturns.

Second, since 2010, policymakers have put in place more than $4 trillion in deficit reduction measures through 2025, not counting additional savings achieved by winding down wars in Iraq and Afghanistan. These measures include restoring Clinton-era tax rates on the wealthiest Americans and discretionary spending restraint. Sequestration cuts account for a minority of the discretionary savings achieved since 2010, and have had a negative impact on critical services and public investments in future growth (see above, A Retrospective on 2013 Sequestration).

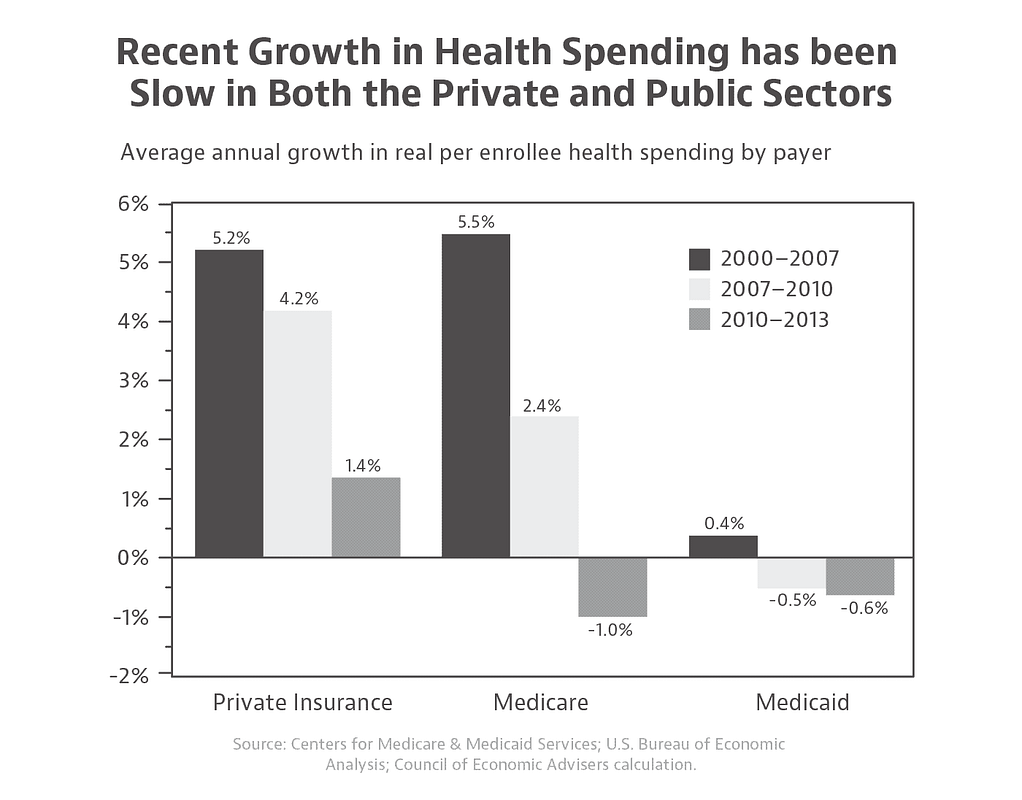

Finally, deficits are falling due to historically slow health care cost growth. The years since 2010 have seen exceptionally slow growth in per-beneficiary health care spending in both private insurance and public programs (see previous chart). As a result, 2011–2013 saw the three slowest years of growth in real inflation-adjusted per-capita national health expenditures since record-keeping began in 1960. While some of the slowdown can be attributed to the Great Recession and its aftermath, there is increasing evidence that much of it is the result of structural changes. These include reforms enacted in the Affordable Care Act that are reducing excessive payments to private insurers and health care providers in Medicare, creating strong incentives for hospitals to reduce readmission rates, and starting to change health care payment structures from volume to value.

The health care cost slowdown is already yielding substantial fiscal dividends. Compared with the 2011 Mid-Session Review, aggregate projected Federal health care spending for 2020 has decreased by $216 billion based on current budget estimates, savings above and beyond the deficit reduction directly attributable to the Affordable Care Act.

The chart below shows how slower health care cost growth and policy changes are contributing to improving the medium-term budget outlook. In the 2011 Mid-Session Review, published in July, 2010, the Administration projected a 2020 deficit of 5.1 percent of GDP if current policies were to continue. The Budget projects a baseline deficit of 3.3 percent of GDP in 2020, a reduction of 1.9 percentage points, or $491 billion. One major contributor to the improvement is lower-than-expected Federal health spending. Revisions to health spending forecasts based on the historically slow growth of the past several years (and based on the assumption that only a portion of the slowdown will continue) account for about half of the net improvement in the projected deficits. Another important factor is the high-income revenue increases enacted in the American Taxpayer Relief Act of 2012, which contributed about a fifth of the new improvement. Discretionary spending restraint has also played a large role, although the impact of sequestration is much less than the impact of the pre-sequestration Budget Control Act caps and prior appropriations action and less than the savings from winding down wars.

An under-appreciated aspect of the Nation’s recent fiscal progress has been the way these same factors, discussed above, have led to a significant improvement in the long-term outlook (as discussed in more detail in the Long Term Budget Outlook chapter of the Analytical Perspectives volume). Moreover, as discussed below, a number of the President’s Budget policies, and particularly the proposed reforms to health and immigration, will not only substantially reduce deficits over the next 10 years, but will have a growing impact in reducing deficits beyond the next decade.

The Budget: A Roadmap for Continued Economic and Fiscal Progress

The progress that has been made to date is significant, but not sufficient to address either the Nation’s economic or fiscal challenges. The Budget increases investments that will accelerate growth and expand opportunity, while also finishing the task of putting the Nation on a sustainable fiscal path.

Investing in Growth and Opportunity. The Bipartisan Budget Act of 2013 reversed a portion of sequestration and allowed for higher investment levels in 2014 and 2015, but it did nothing to alleviate sequestration in 2016. In the absence of congressional action, non-defense discretionary funding in 2016 will be at its lowest level since 2006, adjusted for inflation, even though the need for pro-growth investments in infrastructure, education, and innovation has only increased due to the Great Recession and its aftermath. Inflation-adjusted defense funding will also be at its lowest level since 2006.

The Budget finishes the job of reversing mindless austerity budgeting and makes needed investments in key priorities, even while setting the Nation on a fiscally responsible course. The proposed increases in the discretionary bud- get caps make room for a range of domestic and security investments that will help move the Nation forward. These include investments to strengthen the economy by improving the educa- tion and skills of the U.S. workforce, accelerating scientific discovery, and continuing to bolster manufacturing. They also include program integ- rity initiatives that will reduce the deficit by many times their cost. As described in the Investing in America’s Future chapter, the Budget proposes to further accelerate growth and opportunity and create jobs through pro-work, pro-family tax re- forms and through mandatory investments — or, direct spending that is determined outside the appropriations process — in surface transportation infrastructure, universal pre-kindergarten, child care assistance for middle-class and work- ing families, and other initiatives.

Putting the Nation on a Sustainable Fiscal Path. The Budget achieves $1.8 trillion of deficit reduction over 10 years, primarily from health, tax, and immigration reform. As described further in the Investing in America’s Future chapter, the Budget includes about $400 billion of health savings that grow over time, extending the life of the Medicare Trust Fund by approximately five years, and building on the Affordable Care Act with further incentives to improve quality and control health care cost growth. It also reflects the President’s support for commonsense, comprehensive immigration reform along the lines of the 2013 bipartisan Senate-passed bill. The CBO estimated that the Senate-passed bill would reduce the deficit by about $160 billion over 10 years and by almost $1 trillion over two decades, while the Social Security Actuary estimated that it would reduce Social Security’s 75-year shortfall by eight percent. In addition, the Budget obtains about $640 billion in deficit reduction from reduc- ing tax benefits for high-income households.

Under the Budget, deficits decline to about 2.5 percent of GDP. Starting in 2016, debt de- clines as well, reaching 73.3 percent of GDP in 2025, a reduction of 1.9 percentage points from its peak. The key test of fiscal sustainability is whether debt is stable or declining as a share of the economy, resulting in interest payments that consume a stable or falling share of the Nation’s resources over time. The Budget meets that test, showing that investments in growth and opportunity are compatible with also putting the Nation’s finances on a strong and sustainable path.

The economic growth and progress the Nation has seen in the President’s first six years in of- fice prove that America’s resurgence is real. As the President said it would be, 2014 was a year of action and a breakthrough year for America; a year that saw accelerated job growth, sharp declines in unemployment, uninsured rates at near-record lows, and a continuation of his- torically slow health care price growth. Now it is time to invest in America’s future to drive economic growth and opportunity, secure the Nation’s safety, and put the Nation’s finances on the road to a more sustainable fiscal outlook. The Budget does just that.

Leave a Reply

You must be logged in to post a comment.